Bonds Aren’t Boring Anymore, and Investors Need to Adapt

It was easy to manage bond portfolios during the 40-year bull market that ended in 2020. Since then, things have gotten more complicated - but many investors, even asset management firms, haven’t fully adapted to the new environment.

In the investment world, the stock market gets all the love. It's where fortunes can be made! It's what gets all the attention on CNBC!

Bonds? Booooooring.

Earn interest every year? Yawn.

My guess is that when CNBC invites some bond expert on the channel, they lose half their audience.

But in fact, the bond market and the broader fixed-income market are NOT boring. The fixed-income market (which is essentially the market for all interest-bearing instruments and derivatives associated with these instruments) is a complex interwoven ecosystem with dozens of large and small sub-markets, each with their own dynamics. All of these fixed-income markets play essential roles in the US and global economy, ensuring that banks have liquidity, that insurers and investors have relatively stable returns and that businesses, consumers and governments have ready access to capital.

And bond markets have been somewhat exciting recently, but not in a good way. In 2022, the US bond market experienced one of the worst calendar year returns in US financial market history.

Despite all of this, it's a bit shocking how little attention bonds gets not just in the individual investor-focused media, but also in financial advisor-focused media. But there is a good reason why bonds haven't gotten a lot of attention for a while, as this post will explain.

But first, a short primer on bonds…

Why include bonds as part of the investment portfolio?

Advisors and sophisticated individual investors know that it's important to have some component of an overall portfolio allocated to bonds, or more broadly, interest-bearing investments. For all but the most risk-seeking investors, bonds and other fixed-income investments play an important role in reducing overall portfolio volatility, and even a small allocation to bonds can significantly reduce overall portfolio volatility without reducing expected long-term returns significantly. That is why almost all dated retirement funds allocate a portion of the their portfolio to bonds.

The below chart shows what kind of returns and portfolio return volatility you would have had if you had optimized your portfolio between 1987 and 2022 using three asset classes: (1) US stocks, (2) US Bonds and (3) Short-Term Treasury Bonds (which is a proxy for relatively safe assets):

Source: Chart based on data from Portfolio Visualizer.

As you can see, a stock-heavy portfolio offered greater returns. But with those returns came much greater portfolio return volatility. Bond-heavy portfolios had much lower volatility (but not zero volatility).

Even bond-only portfolios have risks. The most important risk for bonds is interest-rate risk. As interest rates go up in the economy, the market value of bonds declines. And the longer the maturity of the bond, the more that the value of a bond declines.

So for instance, let's say you own two different bonds and market interest rates increase from 5% to 6% across the yield curve.

A one-year bond with a 5% coupon will decline in price by about 1%.

But a 10-year bond with a 5% coupon will decline in price by about 7%.

This is why in most market environments (but not today's market environment!) longer maturity bonds have higher yields than shorter maturity bonds. The additional yield compensates for the greater interest-rate risk of longer-maturity bonds.

That leads us to today's market environment…

Current bond market conditions are weird.

In today's bond market, yields of longer-maturity bonds are lower than those of shorter-maturity bonds.

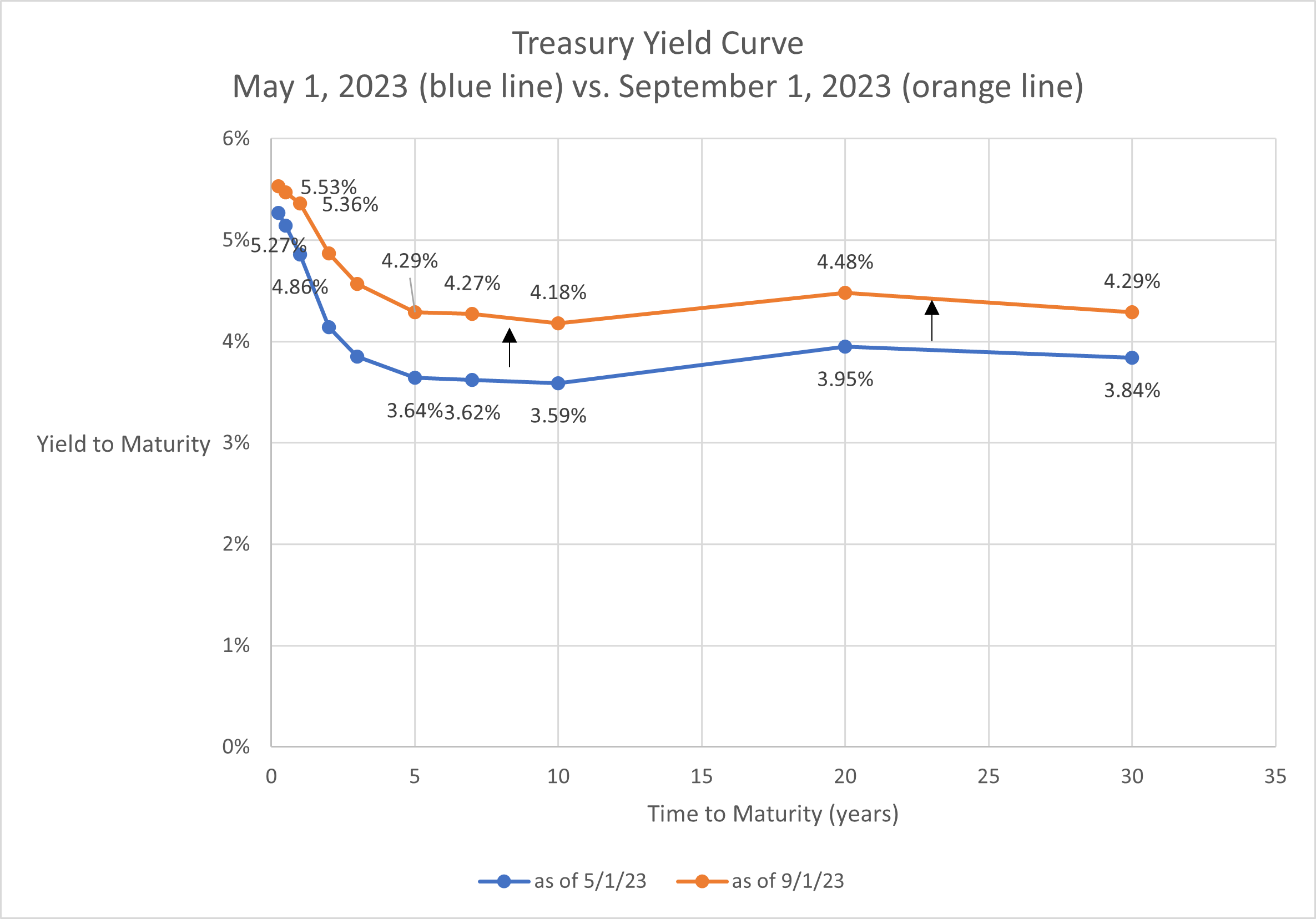

Here is the yield curve as of September 1, 2023. These are the yields that investors are demanding at different length maturities of US Treasury securities.

Data Source: U.S. Treasury Department.

What investors are saying is that they're willing to accept lower yields for longer-maturity bonds, even though longer-maturity bonds have higher interest rate risk. For instance, bond investors want a yield of 5.36% for holding a bond for one year. But they only demand a yield of 4.29% for holding a bond with a five-year maturity.

This is called an inverted yield curve, and this often happens when bond investors expect a recession in the coming months.

So why would bond market investors not require a higher yield for longer maturity bonds when they expect a recession?

The reason is that a recession often leads to a decline in interest rates in the future. Specifically, a couple things would likely happen as part of a recession: (i) inflation would come down as the economy cools off and (ii) the Federal Reserve would reduce the Fed Funds rate to try to boost the economy by making the cost of capital lower.

So think of the current situation as bond investors looking one step ahead in a game of trying to maximize returns. if you are a savvy bond investor willing to bet on a direction in the market and you think long-term yields will be lower in the near future, you want to lock in lock-term yields where they are right now and not wait until those yields decline.

Now it's important to note that the bond market, like the stock market, isn't always correct in forecasting how the market actually evolves. To illustrate this, let's add to the above chart the yield curve as of May 1, 2023 (which is the blue line in the chart below).

Data Source: U.S. Treasury Department.

Guess what? On May 1st, a lot of investors also thought then that bond yields would go down in the future. But what happened is that bond yields actually went up over the last four months!

Why? Because by September 1, it looked less clear that (a) there would be a recession and that (b) that the Federal Reserve would reduce the Fed Funds rate in the near term. So the market has clearly been wrong (at least so far…) in forecasting a near-term recession.

Bonds are interesting again.

This is probably the most interesting period for bond investing since the 1970s, and here a little history lesson is required.

Between 1980 and 2020, investors enjoyed a mostly uninterrupted bull market in bonds. On September 30, 1981, 10-year Treasury bond yields were 15.84%. By March 9, 2020, 10-Year treasury yields bottomed out at 0.54%. During those 40 years, it was pretty hard not to make money in the bond market, especially over longer stretches of time.

Consequently, investors starting taking bond market returns for granted, and over decade a whole generation of amateur and professional investors who had never experienced a terrible downturn in the bond market became some of the most experienced investors.

And since the bond market kept delivering good returns, many investors simply invested in broad-based total bond market index funds, which simply attempted to replicate returns of the overall bond market. And this uncomplicated strategy worked as long as yields kept going down, which they did throughout the 2010s.

But in 2022, bond yields suddenly spiked. Keep in mind that when interest rates go up, the value of bonds goes down. Driven by resurgent inflation and a sharp increase in the Fed Funds rate, the bond market experienced some of the worst calendar year returns in the history of fixed-income finance. Suddenly, bonds weren't so boring, and investors realized that they had to be smarter about managing risks in the bond market.

Many investors reacted to the downturn in 2022 by shifting their money to money market funds, which mostly hold very short-maturity US Treasury-backed securities. This move looked particular attractive given the inverted yield curve. And these investors have largely been rewarded for moving to money market funds. During 2023, money market funds have so far provided excellent income, while longer-duration bonds have yielded less and have generally fallen in value.

What this highlights is that not just professional investors, but also many individual investors as well, are a lot more focused on risks in the bond market and not just returns. This is a big change since the pre-2020 era. It is clear that the set-it-and-forget-it era of fixed-income allocation is over, and a more dynamic investment strategy is required.

Now what? Let's keep in mind the real goal of the fixed-income portion of the portfolio….

So is now that time to move assets from money market funds back to bonds, anticipating that yields will in fact down in the near future? It's hard to say.

And perhaps this is not the right question. Because implicit in the above question is a deeper question: whether or not we should be focused solely on returns when building bond portfolios.

The answer to that question is: no. Because we don't care about just returns; we really care about risk-adjusted returns.

One of the big benefits of money market funds is that money market fund investments, unlike bonds, are highly unlikely to lose value. Money market funds have a mandate to make the lowest-risk investments - that usually means low returns, low risk. But right now money market funds offer relatively high near-term returns and extremely low risk. That is a really good combination.

Whereas moving money into bond funds offers medium-term upside potential (if bond yields go down) but also potential near-term under-performance (less near-term yield than what money market funds are offering) and some medium-term risk (additional potential increases in market yields).

The other consideration is that the choice doesn't have to be either / or. Just like stock portfolios, we want our fixed-income portfolios to be diversified to work in different market environments.

For that reason, a mix of money market and traditional bond holdings may offer the best medium-term risk-adjusted returns in the current market environment. Think of it this way: if yields come down, income from money market funds will decline, but the market value of bond holdings (especially Treasury bonds) may increase. That is a nice potential hedge, the type of risk management necessary in today's environment.

One-note: It is important that investors and advisors really understand the tradeoffs in including a significant allocation of long-maturity bonds in the portfolio. Such an allocation is probably more about chasing potential returns from a rally in bonds, rather than offering truly great risk-adjusted returns given where yields are today. It's also uncertain how much longer-maturity Treasury bonds would rally from current yields, so the upside from holding longer maturity debt is not clear.

Finally, ongoing adaptation will likely be necessary. The best strategy right now may not be the best strategy 12-24 months from now. If yield curve ceases to be inverted, another strategic re-think will likely be needed. In other words, it's time to stop relying solely on Total Bond Market Index funds for the bond portion of the portfolio.

One last word—and implications for 401(k) plan fund offerings and dated retirement funds

To wrap this up, let's go back to a premise at the beginning of this post: the primary purpose of the fixed-income piece of the portfolio is to reduce the overall volatility of the portfolio. We really shouldn't be doing much return chasing in the bond portfolio, and that is likely especially true in an inverted yield curve environment. That likely means going short-maturity and overweighting to Treasuries. In other words, we actually do want our bond holdings to be a bit boring even if the overall bond market is going through exciting times. That is particularly true when real, inflation-adjusted yields are better than they have been for a while.

There are a couple problems in implementing this type of portfolio in practice, and that is that a majority of employer 401(k) and 403(b) plans have terrible bond fund offerings. It is very common in my experience to see 401(k) plans offer 15-20 stock funds but only 3-5 bond funds. Unfortunately, a small selection of bond funds rarely provides access to the types of bond funds that I and many other financial advisors would like to include in our clients' portfolios. 401(k) managers should take note.

The other challenge is that a high proportion of clients' retirement assets is in index fund-driven dated retirement funds. Unfortunately, the bond portion of these dated funds generally have a high proportion of long-maturity bonds…which is again unlikely to be what we as advisors want for our clients in this environment. Dated retirement fund managers should revisit their strategy on relying exclusively on total bond index funds for their portfolios.

The common message to 401(k) plan advisors, dated retirement fund managers, financial advisors and individual investors is the same: the days of easy returns in the bond market are probably over.

That requires this current generation of investors to adopt more sophisticated practices for achieving optimized risk-adjusted returns in the fixed-income portfolio and to consistently revisit their strategies as the market evolves.